Saving money with solar means more funds for your mission.

Some non-profit organizations may not directly benefit from the federal tax credit or depreciation deduction incentives, the State of Illinois SREC program applies to all solar installations. Therefore, a solar system installation is still financially advantageous for nonprofits. Additionally, many nonprofit organizations can use solar leasing or power purchase agreements to transfer the tax benefits to for-profit entities which can lower the cost for the nonprofit.

Either way, the cost savings over time is significant and solar insulates the organization from utility rate increases.

GET YOUR FREE SOLAR SAVINGS REPORT

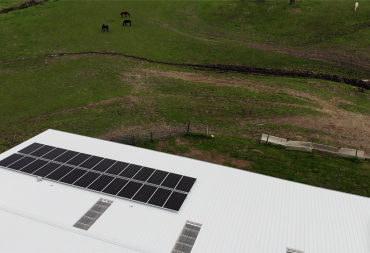

Take a look through our portfolio to see solar power systems we have designed and installed for nonprofits in your community: